On 30th October 2024, the Chancellor delivered the Autumn Budget to Parliament. Below are some of the key changes that could impact those holding precious metals investments and other assets.

It is important to note that the below does not constitute tax or investment advice and merely signposts some of the announcements made earlier this week. The measures outlined below could change at any time, and this article may not be updated. Those wishing to understand how these measures affect them directly should do their own research and seek professional advice from qualified specialists.

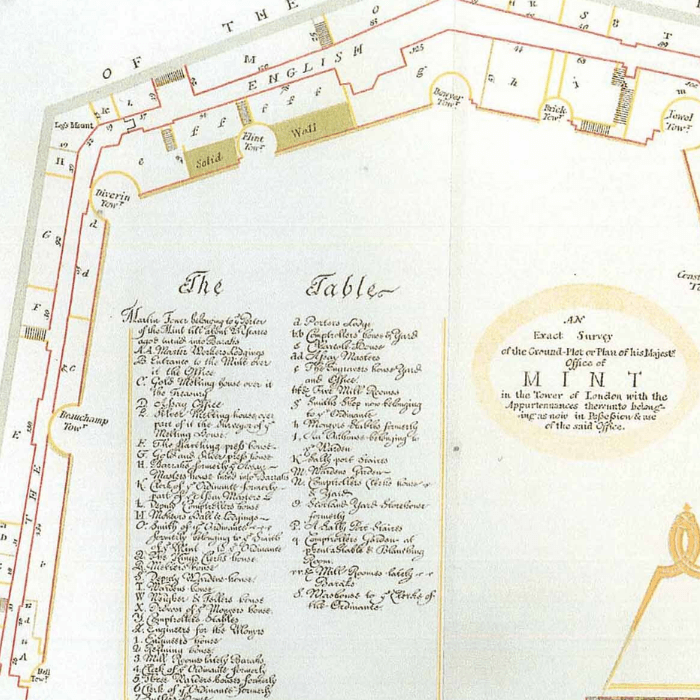

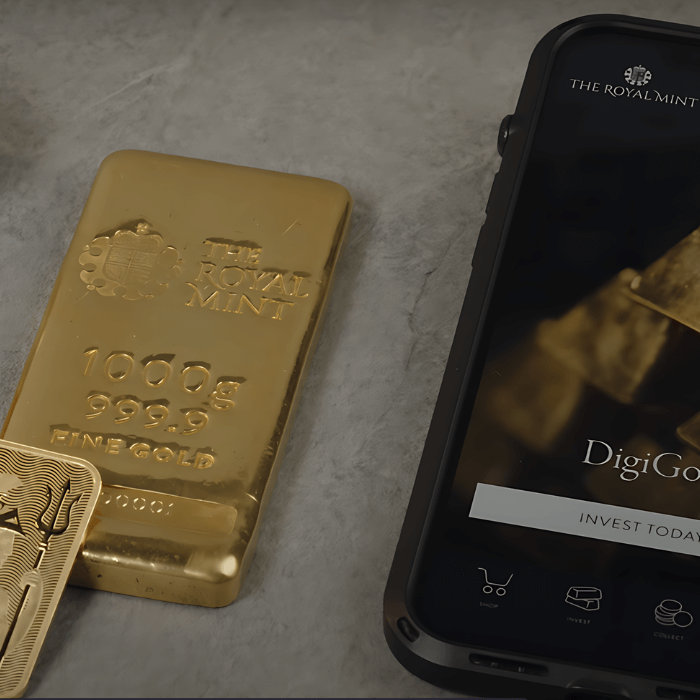

Changes that may impact precious metals investments

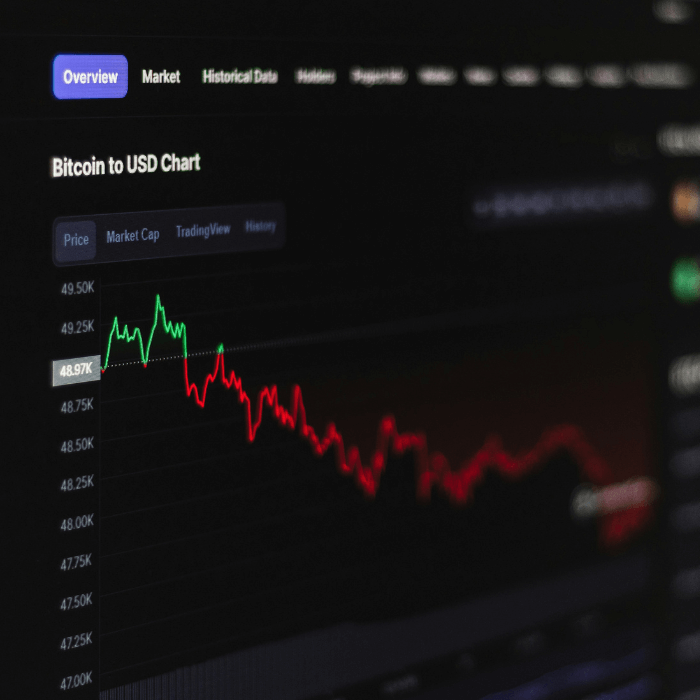

Capital Gains Tax

The rate of Capital Gains Tax for most assets was increased from 10% to 18% for basic rate income taxpayers, and from 20% to 24% for higher rate taxpayers. (Click here for more detail)

Profits from selling UK legal tender coins, including Britannias and Sovereigns, remain exempt from Capital Gains Tax (more detail here and here).

Inheritance Tax on Pensions

Prior to the Budget, pensions such as SIPPs fell outside of a person’s estate for Inheritance Tax purposes, meaning inherited pensions were not subject to Inheritance Tax. The Chancellor announced changes that mean pensions will come into scope for Inheritance Tax from April 2027.

The government have launched a consultation to understand how best to implement this policy (more detail here).

Inheritance Tax Thresholds

The threshold at which Inheritance Tax must be paid will remain the same until 2030. The threshold is £325,000 unless the estate includes a residence that will be passed on to children or grandchildren, in which case the threshold is £500,000. Estates of up to £1m can still be passed on to surviving spouses or civil partners without incurring an Inheritance Tax liability.

(More detail can be found here)

Funding for Green Projects

The Chancellor announced funding for 11 new green hydrogen projects across the UK, and confirmed funding for Great British Energy, a national clean energy entity. The production of green hydrogen often consumes platinum, so these 11 new projects could increase demand for the metal. (More detail on how platinum is used in this process can be found here). Meanwhile, silver is a major component of solar panels, and may see a boost in demand if Great British Energy invests in solar projects.

Other changes

AIM Shares – Stocks listed on the Alternative Investment Market (AIM), a submarket of the London Stock Exchange, will be subject to Inheritance Tax at 20% if the estate exceeds the relevant thresholds, and the shares have been held for more than 2 years. Previously AIM stocks were exempt from Inheritance Tax.

Property – The Stamp Duty surcharge for second homes and buy-to-let properties has been increased from 3% to 5%. This amount is payable in addition to the standard rates of Stamp Duty.

From April 2026, the agricultural property relief and business property relief will be reduced so that Inheritance Tax at 20% is payable after the first £1m of combined business and agricultural assets.

Other Key Announcements

- There will be no increase in the rates of Employee’s National Insurance Contributions, VAT, or Income Tax. Income Tax bands will remain frozen until 2028, but then increase with inflation.

- The government is no longer pursuing the idea of a British ISA.

- The Full State Pension is expected to rise by 4.1% from April 2025.

- The National Living Wage is rising to £12.21 per hour (for people aged 21 and over)

- The 5p cut in Fuel Duty will be maintained for another year.

- From April 2025, Employer’s National Insurance Contributions will rise from 13.8% to 15%, and the threshold (‘secondary threshold’) at which employers must pay NICs will reduce to £5,000.

- There is no increase in Corporation Tax.

- Air Passenger Duty and Vehicle Excise Duty were increased.

- Additional funding was announced for the NHS, defence, and local councils.

Notes

The content of this article is accurate at the time of publishing, is for general information purposes only, and does not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.