Why are the Stars Aligning for Silver?

Category: Invest

![Web Desktop Hero Banner [1600 x 800] 1.png](/globalassets/_ecommerce/invest/reactive-articles/stars-alligned-for/1200x600---stars-for-silver-desktop.png)

At the turn of March, the silver price began its impulse move higher, starting from a well-established base around the £18 level, where the silver price had been trading in an ever-tighter range for the past 18 months.

The first move higher took the price to the £23 level (+33%) over a matter of six weeks, with a second push seeing the price reach the recent highs of £25 (c.+39%) in the latter part of last month (May).

This extended move now means silver has outperformed over the past 12 months; gold is up approximately 17%, whilst silver has risen more than 24%. The silver price is now consolidating between £23 and £24 per troy ounce.

But why has the silver price sprung into action?

Well, silver demand is forecast to be the second highest on record this year, coupled with a fourth consecutive year of supply deficits, to provide some fundamental backdrop. (MorningStar)

Silver also holds a unique position in the commodities market due to its dual role as both a precious metal and an industrial metal. Approximately half of the global silver demand comes from industrial applications. Recent advancements and expansions in industries such as electronics, solar energy and electric vehicles have significantly increased the demand for silver.

Electronics: Silver is a key component in various electronic devices due to its excellent conductivity.

Solar Energy: The photovoltaic cells in solar panels rely heavily on silver, and the push towards renewable energy sources has spiked its demand.

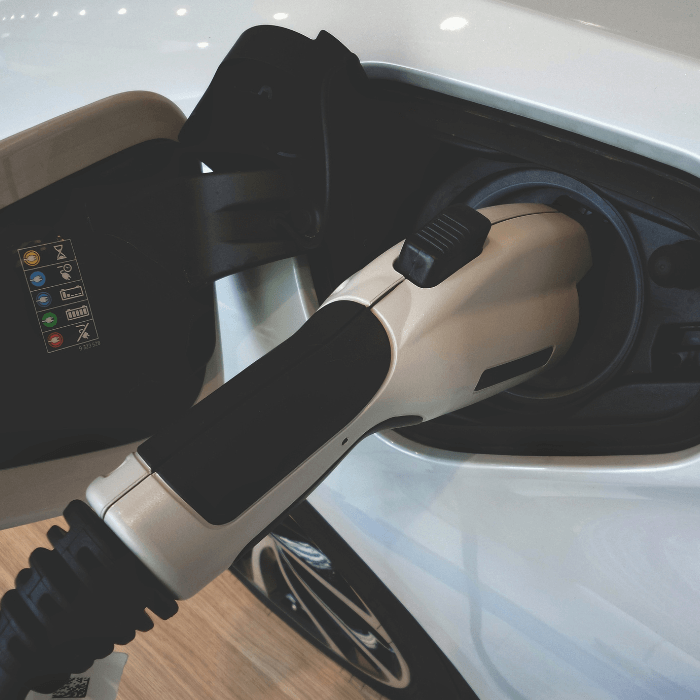

Electric Vehicles (EVs): As the automotive industry shifts towards electric vehicles, the need for silver, which is used in batteries and electrical connections, has grown.

We recently published an article on ‘The Investment Case for Silver Investment’ which outlines the key drivers to the silver price, and the interaction of various supply and demand dynamics.

The Royal Mint offers a wide variety of precious metal bullion bars and coins (Capital Gains Tax – CGT – exempt*) and combines quality craftsmanship with world-class vaulting arrangements. Discover more about our silver bullion range here.

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.

Sources:

MorningStar: It may be silver’s turn to shine after the gold rush to record high prices - MarketWatch